Investing in bullion can be a prudent way to hedge your portfolio, but choosing the right format is crucial. Both popular options are Gold IRAs and physical gold. A Gold IRA allows investors to hold gold within a retirement account, while physical gold refers to tangible gold bars. Understanding the nuances of each is essential to making an informed decision.

Provides several advantages, including tax-deferred growth and potential for appreciation. Offers a sense of ownership and tangible asset value, but it comes with risks associated with. Your individual needs will ultimately determine which choice is best for you. It's always a good idea to talk to a financial advisor and make the right decision.

- Consider your investment horizon and risk appetite.

- Evaluate the tax implications of each option.

- Research reputable custodians for Gold IRAs.

- Choose a secure storage solution for physical gold.

Gold IRA vs. 401(k): A Comprehensive Comparison

When planning for retirement, investors often face the decision of selecting the best investment strategy. Two popular options include a conventional IRA focused on gold and a 401(k), a retirement plan offered by many employers. Each option presents unique advantages and disadvantages, making it crucial to understand their key variations. A Gold IRA offers the opportunity for asset growth through precious metals, potentially protecting your wealth against inflation. Conversely, a 401(k) allows for contributions from both you and your employer, often with matching benefits, maximizing your retirement savings.

Ultimately, the optimal choice depends on your individual financial objectives and risk tolerance.

- Asset allocation

- Tax implications

- Management costs

Unlocking Your Retirement Potential: Gold IRA Pros and Cons

Planning for retirement can be a complex process, but exploring diverse investment Gold IRA Reddit options is crucial. A Gold Individual Retirement Account (IRA) presents a unique avenue to diversify your portfolio and potentially preserve your wealth against inflation. However, like any financial instrument, it comes with its own set of advantages and disadvantages. A Gold IRA allows you to invest in physical gold bullion or coins, offering a tangible asset that historically has maintained value during economic uncertainty. Moreover, gold can act as a hedge against inflation, potentially preserving your purchasing power over time.

On the downside, Gold IRAs often come with higher fees than traditional IRAs due to the complexities of handling physical assets. Moreover, the value of gold can fluctuate significantly, making it its performance unpredictable in the short term. It's essential to conduct thorough research and consult with a qualified financial advisor to determine if a Gold IRA is the right fit for your retirement strategy.

- Assess your investment goals and risk tolerance

- Research different Gold IRA providers and their fees

- Consult a financial advisor to get personalized advice

Leading Gold IRAs for Secure & Diversified Investments

Considering a transition to precious metals? A Gold IRA can provide a reliable avenue for expanding your retirement portfolio. With interest rates wavering, gold has historically served as a buffer against market volatility. Many reputable firms specialize in Gold IRAs, but navigating the landscape can be overwhelming.

- Top-tier financial companies offer a comprehensive range of Gold IRA services. Examining their track record and fees is crucial before investing.

- When evaluating Gold IRA providers, factor in the security of your holdings. Established firms implement stringent measures to guarantee the safety of your investments.

- Strategic distribution is key for any investment. A Gold IRA can supplement a diversified portfolio by offering a non-correlated asset class.

Maximize your investments with a Gold IRA

Investing in precious metals like gold through a Gold IRA can be a savvy strategy to protect your savings. But, with numerous providers vying for your business, selecting the ideal Gold IRA organization is crucial. To make an informed choice, consider factors like expenses, customer service, and the standing of the company. A reputable Gold IRA provider will offer transparency in their pricing and provide detailed information about the system.

- Research several Gold IRA firms before making a choice.

- Carefully examine the charges associated with each company.

- Evaluate the services offered by different companies.

- Read testimonials from other investors.

- Ensure the Gold IRA company is properly licensed.

Supercharge Your Golden Years with a Gold IRA

Are you seeking out ways to safeguard your financial future? A conventional IRA can be a powerful tool, but consider adding gold to the mix. Investing in a Gold IRA offers special advantages that can help you boost your retirement savings.

- First, gold is a historically solid asset that tends to preserve its price even during economic uncertainty.

- Additionally, a Gold IRA provides asset allocation, lowering your overall portfolio vulnerability.

- Lastly, gold can act as a safe haven in times of economic instability, helping to protect the value of your savings over time.

Consult with a qualified retirement specialist today to discover how a Gold IRA can benefit you in reaching your retirement goals.

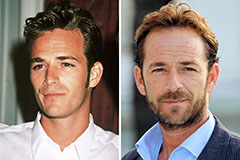

Luke Perry Then & Now!

Luke Perry Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!